Observations following our participation in the “operating theatre of 2030” conference at Giant Health 2025

At the Giant Health Event 2025, Jack Severs spoke on innovation trends and challenges in securing protection for innovations in computer-aided surgery, which followed a panel discussion by leading surgeons using robotic surgery in their clinical practice.

Having tracked innovation trends in robotic and computer-aided surgery for several years, while advising companies on the protection of these technologies, it was fascinating hearing directly from experienced surgeons who are now routinely using these systems in clinical practice. It also confirmed that the trends we are seeing in the filing data are not abstract, but a reflection of a sector that has moved decisively from promise to practice.

From emerging technology to a mature market

A recurring theme from the panel was how far robotic surgery has come. Early adopters spoke of a period when systems were still evolving rapidly and it was not always clear where the technology would ultimately land. Today, by contrast, robotic platforms are increasingly seen as mature tools embedded within clinical workflows.

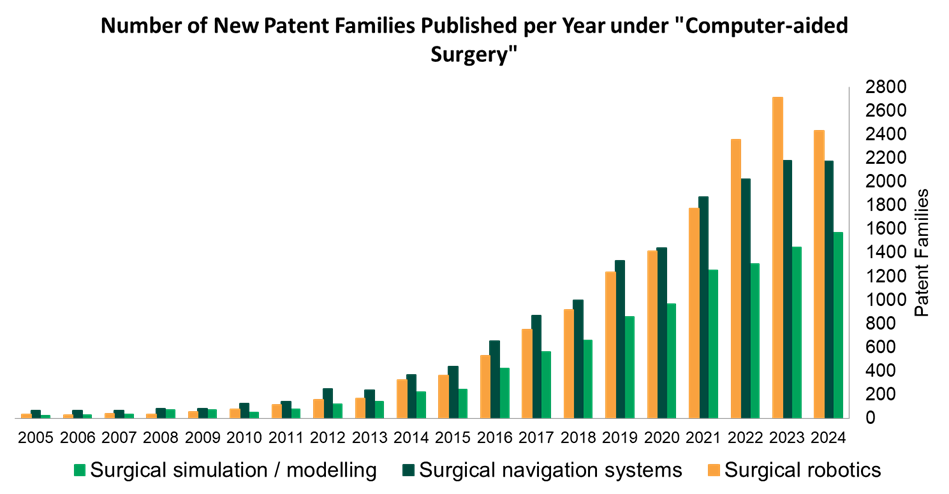

This shift is mirrored clearly in the patent filing data, as shown in Figure 1. It includes the number of patent families filed in three key International Patent Classification (IPC) codes:

- Computer-aided planning, simulation or modelling of surgical operations (A61B 34/10)

- Surgical navigation systems; Devices for tracking or guiding surgical instruments, (A61B 34/20)

- Surgical robots (A61B 34/30)

Over the last two decades, there has been sustained growth in patent families across computer-aided surgery as a whole, with particularly strong activity in surgical robotics, navigation systems, and image-guided interventions. More recently, however, filings relating specifically to core robotic hardware appear to be levelling off, suggesting a maturing technology base rather than a slowing of innovation overall.

Choice, competition, and clinical fit

Another strong message from the surgeons was the growing range of systems now available. Hospitals and surgical teams are no longer choosing whether to adopt robotic surgery, but which system best fits their clinical needs, budget, and procedural focus. The ability to support a broad range of procedures was highlighted as a key decision factor.

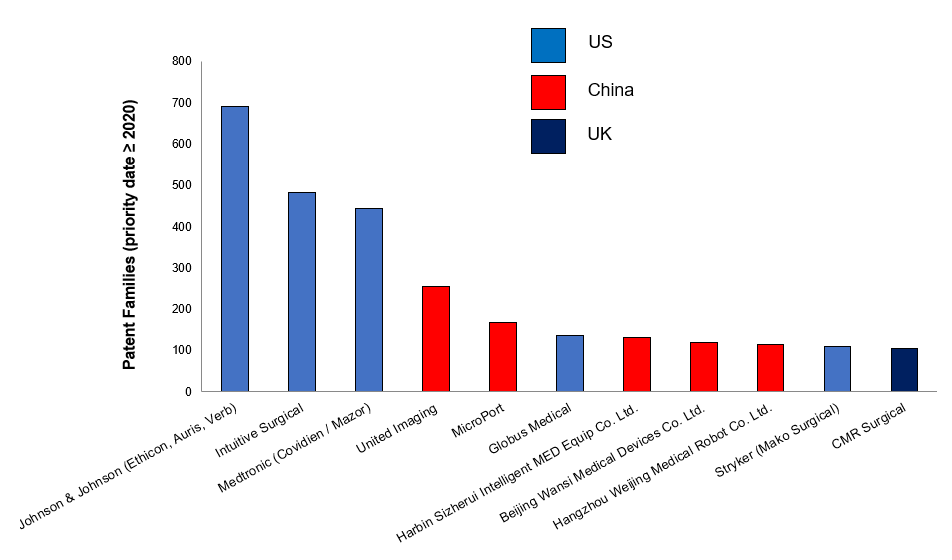

Again, the patent data, shown in Figure 2 indicating the top 11 patent applicants in this technology sector, supports this narrative. While a small number of large companies still dominate total filing volumes, there is now a broad field of players with significant patent activity. These applicants are primarily based in the US and China, with CMR Surgical being the only UK-based company among these top filers. This diversification in patent ownership reflects a competitive market offering genuine choice rather than a single-platform landscape.

Shifting challenges: training, access, and optimisation

With the core technologies now well established, the panel discussion turned to a different set of challenges: how to extract maximum value from these systems and how to ensure they are accessible to the next generation of surgeons. Time pressures, limited access to operating theatres, and patient-safety considerations all constrain hands-on training for junior clinicians.

In this context, augmented reality (AR), virtual reality (VR), and advanced simulation tools were repeatedly highlighted as critical enablers. These technologies allow surgeons to observe procedures remotely, rehearse complex cases, and build familiarity with robotic systems before entering the operating theatre.

The patent landscape shows strong and continuing growth in exactly these areas. While filings in surgical robotics itself may be stabilising, innovation in digital technologies such as surgical simulation, navigation, and pre-operative planning remains on a steep upward trajectory. This suggests a strategic shift in R&D focus: from building the robot to optimising how it is used.

Innovation beyond the industry giants

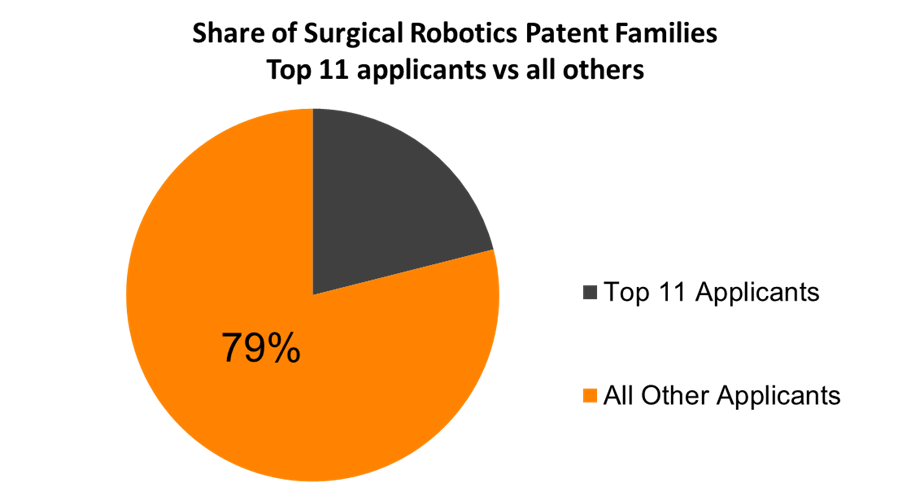

One of the more surprising insights from the patent analysis is where the bulk of innovation in this technology sector is actually coming from. Despite the prominence of a handful of global players, around 80% of patent families in this space are filed by companies outside the top 11 applicants shown in the chart above.

This has important implications and underscores the need for emerging companies to secure robust patent protection early, not only to defend their innovations but also to attract investment and position themselves within an increasingly crowded market.

Patent protection at the intersection of complex law

Securing strong patent protection in computer-aided and robotic surgery in the UK and Europe is not always straightforward. These technologies sit at the intersection of several complex and evolving areas of patent law, including:

- the exclusion of methods of treatment by surgery or therapy,

- restrictions on certain types of software inventions, and

- limits on the patentability of mathematical methods, which are particularly relevant to AI-driven solutions.

Our analysis shows that even these large, experienced applicants encounter objections, especially in Europe, relating to methods of treatment by surgery. In many cases, these objections appear avoidable, and it may be that many applications originate from US filings, where the legal framework differs, and are not sufficiently adapted for European prosecution. Careful framing of the invention, with a focus on the technical systems that enable new techniques, rather than surgical acts themselves, can improve outcomes.

It was interesting to see how closely the surgeons’ real-world experiences aligned with the innovation trends we are seeing. Both point to a sector that continues to innovate rapidly, but with a shifting emphasis from innovation in the robotic systems and hardware to digital innovations enabling their application. Given the complex legal landscape, it is essential that innovators and their IP advisers can navigate these challenges effectively. The result will be securing strong protection and best position innovators during the wider development and roll out of these innovative digital surgical technologies.